DeTrended #9: Decoding The Headlines Through Technical Truth

Your free weekly newsletter from an Econ PhD Student. Removing market noise through data insights. Premium trade set ups coming soon! 🔒

Headline Pessimism Persists, SPY’s Most Hated Rally Nears All Time High, Cyclical Oscillators Continue to Grow

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” — John Templeton

Market Psychology 101: Negative headlines draw more attention than positive ones. Investors are drawn to fear and often seek excuses to sell. Major financial institutions amplify this sentiment to encourage selling at lower prices.

Summary

DeTrended #8 discussed the trends percentage bands on SPY being the most overstretched in over a decade, indicating an expected price retracement yet to emerge. Instead, price approaches all time high with minor pull backs. While headlines declare ‘War! Recession! Collapse!’ confidence in stocks continue to surge as big money buys the ‘Fear and FUD’ disease, spreading through retail minds.

Bitcoin’s de-correlation from the SPY has realigned while market participants hinge on the next event announcement. Alt-season seems further and further away with each passing ‘pump and dump’, while Bitcoin miners had an incredible Q2! Bitcoin’s anticipated retracement is underway, but with such a strong trend has potentially completed on Friday with the thrust to $102.6k.

Global yields remain in their elevated ranges delaying rate cuts. War news sparked some life into commodities like oil & wheat, Silver moons while gold is challenging all-time high, with some major financial analysts predicting a $10,000 price in the next two years. However, technical data suggests gold has topped out, showing weekly bearish divergence in the short term.

DeTrend Price - Cyclical Timing Models

Relative Cyclical Oscillator (Stock market top / bottom cycle leading indicator) inched up to 53.2 from the buy zone (<40) in April suggesting price has much higher to go in the long term.

BCRO (Bitcoin cycle top / bottom leading indicator) inched up to 64.71, also suggesting price has much higher to go this cycle.

DeTrend Time - Renko SD

See the full asset list of updated models - AAVE, ETH, FET, TSLA, GOOGLE, SUI, XRP and much more

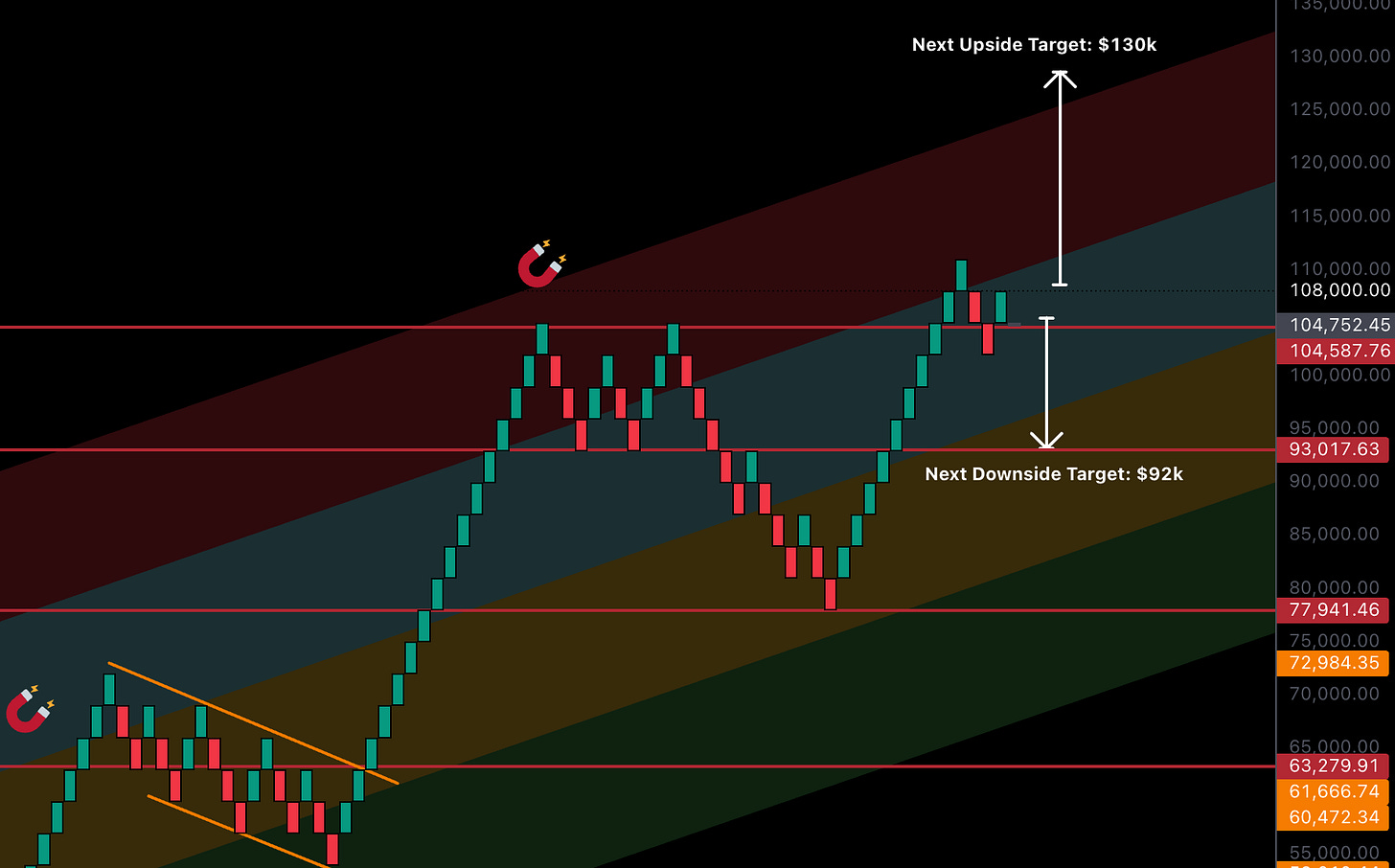

Removing time, Bitcoin Standard Deviation channels have a short term extreme upside target of $130k and a continued retracement target of $92k. Terminal target for 2026 Q1 is $211k.

The SPX500 model is only just getting started after the Q1 pull back into the opportunity green zone. There is a gap expected to be filled at $5720 but this does not HAVE to fill if it is a runaway gap. Q4 extreme targets are $8200 provided we have a boom at some point, more realistic targets remain $7200.

Sentiment

Etoro Frustation & Gloating Index is back down to Neutral Doubt (50.72) from high gloating in a matter of weeks. Sentiment gauges have been more volatile than usual since Trump’s 2nd term demonstrating strong uncertainty amongst participants.

Investment Focus: BTC for growth, Miners for Alpha

Data points to an exponential growth curve for Bitcoin, driven by “scarcity engineering” from $MSTR, sparking a new wave of buyers, including 21, MetaPlanet, nations, and U.S. states, all adding Bitcoin to their treasuries. With the abolishment of SAB-121, banks will follow. Bitcoin miners look undervalued, as collectors and keepers of the coin.

Why is price only $105k? Who is selling? Glass node analysts show old retail wallets are selling heavily at this level, enough to offset growing demand from institutions. This can persist for a while but supply will likely be exhausted sooner rather than later.

Trading Focus: Alt-coins, MAG7, BTC Miners, Commodities

Strong retracements will provide new signals for swing traders and offer investors another entry point. Risk management and patience are your secret weapons for navigating these market conditions, as always. Prices appear poised to correct further from overstretched technical indicators but as they say ‘prices can stay irrational longer than you can stay liquid’.

Macro trends have turned bullish on the MAG 7. Alt-coins & miners have hit their “Golden Pocket” (78.6% Fibonacci retracement), a high-probability bottom. Notable Alt-Coins outperforming from local bottom are AAVE, BNB, SUI.

Our portfolio has opened and took profit on many trades so far in the last month and will continue to grow our positions as opportunities present themselves. Holding periods may exceed a year, with profit-taking along the way.

Weekly Trade Set Ups

Coin is testing the daily pivot and .236 Fibonacci retracement as support after breaking through into resistance. A successful retest and bullish engulfing candle could push price 35% to the next pivot point and all time high. Ill be watching for the signal to go long.